Laing O’Rourke sees profit rise despite bringing forward COVID hit

Laing O’Rourke’s profit increased in its last financial year, despite bringing forward a hit from the COVID-19 pandemic.

Laing O’Rourke’s profit increased in its last financial year, despite bringing forward a hit from the COVID-19 pandemic.

1st Class Ltd are please to announce approval to the CHAS Scheme

CHAS (The Contractors Health and Safety Assessment Scheme) is a pre-approval scheme, which allows contractors to demonstrate to potential clients that they meet the required health and safety standards.

Construction industry companies claiming through the government’s job retention scheme hit £3.2bn at the end of July, new data released by HMRC has revealed.

Despite almost half (45%) of buyers asking for a price reduction on properties in light of the COVID-19 pandemic, home sellers are not budging on price according to the latest research by online estate agent Strike.

The area most likely for buyers to ask for a price reduction is London, where 70% of sellers say they’ve been asked to lower their property prices. Alternatively, regions including Northern Ireland and the South West saw buyers less likely to ask for a price reduction. On a UK-wide basis, just one fifth of sellers say no reduction has been asked for at all in recent months.

The tower, which will be opposite 100 Greengate in Salford.

Laing O’Rourke has been named as preferred bidder on a £160m 55-storey residential tower at Greengate in Salford, Greater Manchester.

Developer One Heritage has signed a pre-construction services agreement with the firm on the project which will include 545 flats, ground floor commercial units and a new riverside walkway.

Much of the building is set to be delivered offsite by Laing’s off-site factory in Worksop, Nottinghamshire, which the project team said will help enable social distancing.

One Heritage director Jason Upton said: “This is a flagship scheme for the north west and it’s fitting that we’re working with a globally-recognised contractor. Laing O’Rourke have responded energetically to the challenge and demonstrated their appetite for working alongside us.”

Work is expected to start on site in the third quarter of the year, with the scheme targeted for completion in 2024.

Laing O’Rourke’s off-site factory generated revenue of £35m in the year to 31 March 2019, though it did not yet generate a profit as a standalone operation. The firm has been targeting an increase in its use as part of its business strategy.

The Construction Skills Certification Scheme (CSCS) are currently experiencing difficulties issuing cards to first-time applicants or those wishing to renew.

The problem stems from the need for all applications to be supported by a passed CITB Health, Safety and Environment (HS&E) test within the last 2 years.

CITB have confirmed that all accredited test centres across the UK are closed until further notice during the pandemic. Although the situation is continually reviewed the industry needs to consider the impact on CSCS card renewals and applications. In the short term, those new to the industry cannot apply for cards because they cannot undertake training, gain qualifications or sit the necessary test. In addition, qualified construction workers whose cards have expired may find that they are turned away from sites.

To help ease the situation CSCS are asking employers and site managers to use their discretion and review each cardholder’s request to access work on an individual basis. With this in mind the grace period for card renewals has been extended from 6 months to 12 months after the expiry date. CITB will soon launch a temporary ‘LITE’ version of the test which may involve the issue of a temporary card until Covid-19 is brought under control. Visit the CITB website for developments.

Source: www.cscs.uk.com

Brexit uncertainty has given a boost to France-based Altrad’s scaffold rental business over the past year.

The company’s CEO Louis Huetz told IRN, “Even during the uncertainty caused by Brexit, it did not really affect our rental business in the UK. In fact, people made a switch from buying more to hiring more because they didn’t want to be too committed, so they chose to hire solutions.”

The company has an Equipment business that operates only in Europe and accounts for about 20% of total group revenues. The other 80% is generated by Altrad’s global Industrial Services business.

As part of the Equipment business, Altrad rents scaffolding in the UK, Germany, France, Poland and the Netherlands.

“The UK is the main market for scaffolding rental because British companies tend to hire more than they buy, whereas on the continent companies tend to buy more than they hire,” said Huetz.

Before the turmoil caused by Brexit, the split between the sale and rental of scaffolding in the UK was 70/30, according to Huetz. Over the past year, as the Brexit turbulence reached a climax, that split shifted to about 60/40.

This change happened quite quickly in early 2019, so the company had to quickly invest more in its rental fleet to respond to the higher demand; “There was no problem with storage; it was more a problem of demand for additional CapEx because we needed to have more hire equipment, so that means purchasing more,” said Huetz.

Without putting an exact figure on it, Huetz said the company invested several tens of millions of euros.

Although the rental business across Europe is not fast-growing, it is stable, according to Huetz.

“The rental business in France and Benelux is doing well, and Poland also. But in Germany there has been a slowdown over the past six months, but it is more on the sales side than the hire side because Germans tend to buy their own equipment,” said Huetz, attributing this to a slowing German economy, which is impacting the construction sector.

Looking ahead at how the market for scaffolding rental might develop in the future, Huetz said, “It’s an interesting market. We are also developing in other countries, especially Italy. Also in Eastern Europe.”

Altrad intends to continue expanding its rental business, with an estimated CapEx figure of at least €10 million annually, according to Huetz; “We will see how things develop, but we are prepared to invest in the region as much as we need to increase our market share.”

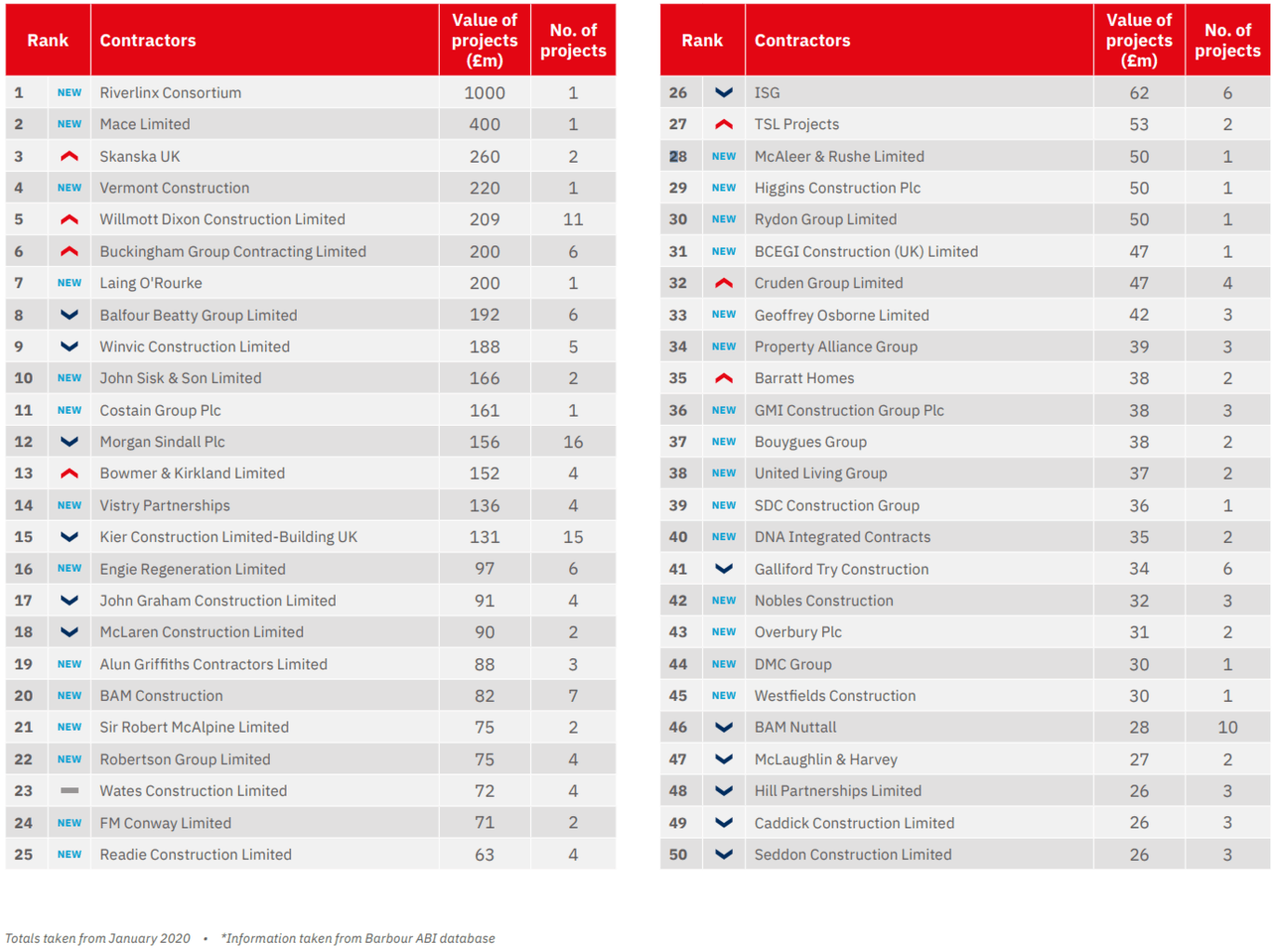

While Mace and Skanska were in second and third place with a total contract award value of £400 million and £260 million respectively. This month, the top three contractors have been awarded a combined four projects at a total value of £1.66 billion.

The latest edition of the Top 50 League Tables published by industry analysts Barbour ABI, highlights the number and value of construction contracts awarded during January. This month shows that the combined value of contracts awarded to the Top 50 was £5.5 billion with a total of 182 projects.

The overall value of all projects awarded to the top 50 contractors is up by 178% on December 2019 when the total value of projects was just £1.98 billion. The total quantity of projects also increased by 75% from December to January, suggesting that there have been both a number of high value contract awards as well as an increase in quantity of contract awards.

Tom Hall, Chief Economist at Barbour ABI & AMA Research said, “Activity has increased in January considerably compared to the latter months of 2019. However, these figures have been boosted by several major projects”.